On July 12, 2022, the euro/dollar parity was reached. In this way, it is revealed the weakness of the common European currency (EUR) against the queen currency (USD).

But what is really significant is how this exchange rate scenario affects exporting companies. Therefore, in this article we present the current situation, causes and consequences of the parity of the euro against the US dollar for exports in Spain.

Índice

Evolution of the euro/dollar currency pair (EUR/USD)

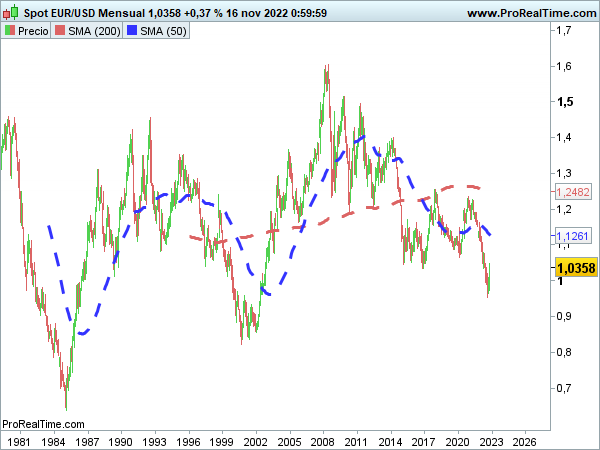

You have to go back to 2002 to see this level of the euro against the US dollar.

At that time the context was completely different; the common currency did not yet have a physical form. The issue of the euro took place in January of that same year and produced an appreciation until reaching 1 euro = 1.60 United States dollarss. This exchange rate was the maximum that the euro reached in its entire history.

Subsequently, with the 2015 oil crash, the EUR/USD currency pair fell to 1.03. But it was not until after the outbreak of the war in eastern Europe and the consequent energy crisis that an exchange rate of 1 EUR = 1 USD.

Although, the average exchange rate since January 1996 of the euro/dollar currency pair stands at 1.2482.

(NOTE: The euro as a currency was introduced in January 1999 and began to circulate in January 2002. It was previously in preparation.)

Why has the euro/dollar parity been reached?

In addition to the fact that the energy crisis has a more direct impact on Europe, the monetary policies of the United States Federal Reserve to address inflation They have been more aggressive.

The higher the interest rate of a currency, the greater its demand, since capital flows to where better returns are offered. In this way, it causes an increase in its price against other currencies.

The increases in the interest rates of the dollar have been carried out in a firm way. At the meeting held on March 16, 2022, the first interest rate increase was decided. This first rise was only 25 basis points (from an interest rate of 0.00% to 0.25%).

On November 3, US dollar interest rates already reached 3.00% and increased by another 75 basis points (to 3.75%).

In this sense, The European Central Bank has shown a more conservative interest rate hike program. It was not until the meeting on July 27 that it was decided to increase rates by 50 basis points (from 0.00% to 0.50%). Two additional increases of 75 basis points each have been carried out throughout the year. Currently, the official interest rates for the euro are at 2.00%.

On the other hand, one must also add the fact that the US dollar is a store of value and in times of uncertainty, such as the present, it has higher demand.

So while the dollar strengthens, the common currency suffers some weakness. There is even talk of a risk of recession in the euro zone.

What consequences does the euro/dollar parity have for exporting companies?

Exchange rates have a direct impact on a country's trade balance. On one side, a weak euro means greater export competitiveness. Purchases are cheaper, since the price of the euro against the dollar is lower.

However, it should be borne in mind that a lower value of the euro also means an increase in the cost of importss. Above all, it affects energy materials, the price of which has a direct impact on inflation.

In fact, in the Foreign Trade report (COMEX) of August 2022 published by the Ministry of Industry, Commerce and Tourism, shows how Spanish exports of goods have experienced a rebound of 31.7% with respect to the same month of the previous year (interannual rate).

For its part, the energy deficit increased to 4,515.9 million euros, versus the 2,397.6 million euros registered in August 2021 with provisional data (practically double).

The point is that a higher price of energy brings with it an inflationary spike; and it serves as an incentive for the European Central Bank to continue with its interest rate hike program, it may even take more dynamic actions.

All this has consequences on credit facilities for Spanish exporting companies.

Consequently, the result of the increase in value of the dollar against the euro could be summed up in an improvement in the capacity of foreign sales, but with worse conditions of access to credit.

However, there are alternative formulas for export financing which can be used to solve the problems that the euro/dollar parity brings with it and take advantage of the opportunities to improve competitiveness and sales capacity.

Are you looking for financing to export your products?

At Alter Finance we are redefining export financing thanks to our Export Leasing. The largest platform with more than 50 countries, being able to finance your exports to all those markets.

In addition, at AlterFinance, if you need to obtain liquidity by collecting the invoices of your exported products in advance or cover the previous production expenses of said products, we can help you finance your exports with our tools export financing.