Today we are going to talk about a choice that some entrepreneurs make at certain moments in the life of the company: Line of credit vs. Invoice advance.

To deal with situations reviews of financial scope of a business, there are numerous options depending on the characteristics of the need you have. If you don't have much experience in this field or the amount of possibilities you can choose from overwhelms you, in today's post we want to explain what differences you can find between a credit line and a down payment of invoices. And also know Which one would you choose depending on your situation.

Índice

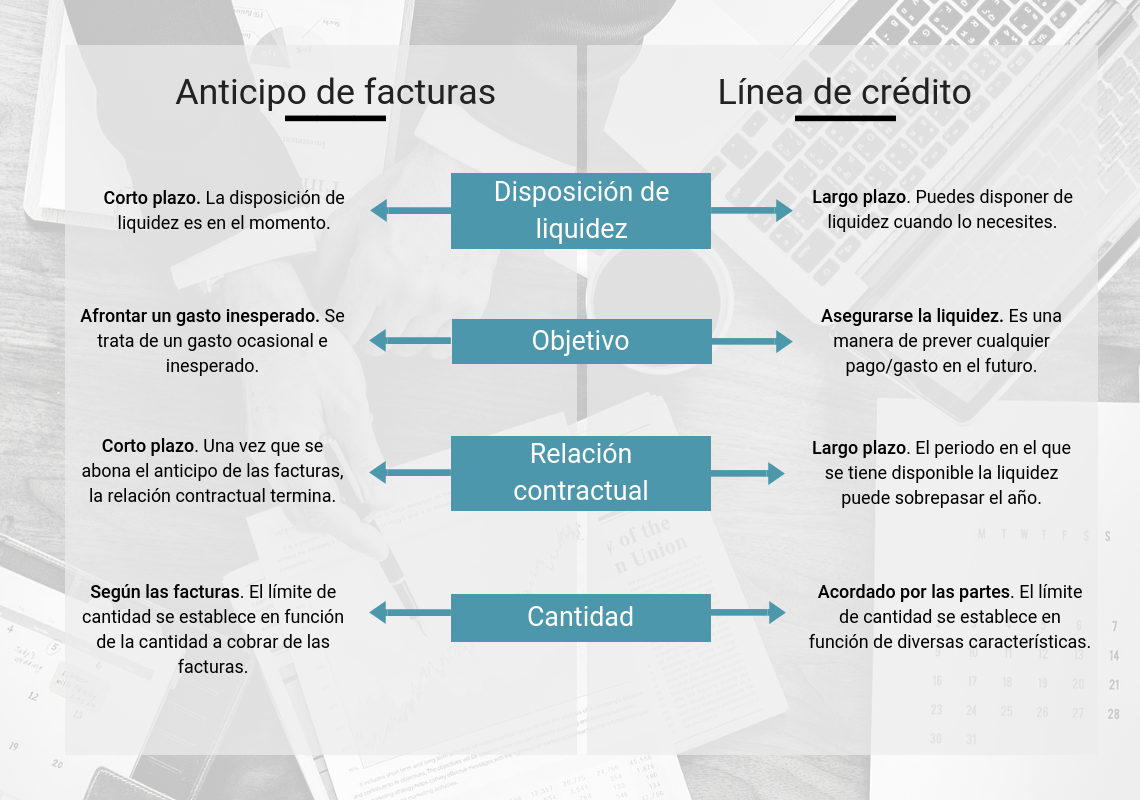

Line of credit vs. invoice advance

What is a line of credit?

This financial resource is offered by a banking entity, and consists in the fact that it makes available to the company a agreed amount of liquidity which you can use in time that suits you best. For example, if one month you find yourself in the situation that you do not have credit to pay your employees because you have not yet charged your customers, you can use this resource.

Therefore, the availability of liquidity exists even though its use is not mandatory. What can be assured (in most cases) are the commissions for that amount available. Depending on this and the time, the financial institution will establish opening commissions and line maintenance interest.

Once he term has ended, the company must settle the debt with the financial entity with the agreed amount. Therefore, not repaid in installments How could a loan be? Likewise, once this period has arrived and the amount has been returned, you can renew for another period of time agreed by both parties.

What is the invoice advance?

Many people confuse the invoice advance and Factoring, since they are two alternative financial resources that have very similar characteristics, although it is not the same tool. The big difference between the two is that the Factoring implies a much more durable contract over time, since it can include a management of the collection of the invoices, a reconciliation of the collections, a coverage for non-payment, etc.

He invoice advance therefore includes a agile and fast process regarding its execution. The companies that hire you can obtain the liquidity of your invoices at the time and without waiting for them to reach their expiration date.

When to choose each

The two options that we have described in the previous section are intended to offer liquidity when you need it, due to an unforeseen expense or some circumstance that leads you to not be able to meet the recurring payments of your business. However, you must take into account the following points before choosing any of them:

1. Study the contract conditions

What kind of interest and commissions each contract can have, if you will be able to face them and which one suits you best depending on the situation in which you find yourself. The advantage of alternative financing of today is that is not regulated by any commercial lawTherefore, contracts can be created with the conditions that best suit their participants.

2. Is the decision worth it?

The basic thing is to know that the cost that this type of operation will take you compensated with the result of them. And this not only depends on the operation of and the assignor of the credit, but also on your own situation as a business.

3. The purpose of that liquidity

The reason why you use one of these modalities It is essential to make a decision. With proper and detailed financial planning, you will not only maintain your business in the market, but you will get make it grow to the goals you have set for yourself.

Here we list some of the situations to be aware of at the time of choose one of these two alternative financing modalities, so that your choice is the most appropriate for your company:

Conclusion

In short, if what you need is liquidity at a certain time and you anticipate that you will not need it again in the near future, then your choice is the invoice advance. While, on the other hand, if you are accustomed to this type of unforeseen and you do not want to risk the profitability of your business, then your choice should be a credit line.

In any case, and as we always say, it is important that Before making a decision, study the situation, the steps you could take and the results they offer you. A good management of your financing it can be what differentiates the success of the failure of your business.

Do you like what you are reading?

Subscribe and receive incredible content

credit request

Hello Diego, thank you for filling out our contact form, we hope that our advisors can guide you to make the credit application that best suits the needs of your company.