The real estate sector is one of the sectors that suffers the most in a scenario of interest rate rises. The increases in the price of money are transferred to the interbank market, causing a increase in mortgages and higher costs in the promotion of new construction.

Therefore, it is worth analyzing the situation of interest rates in 2022, the existing forecasts and the consequences for the land and housing market.

Índice

Situation and forecast of interest rates in Spain 2022

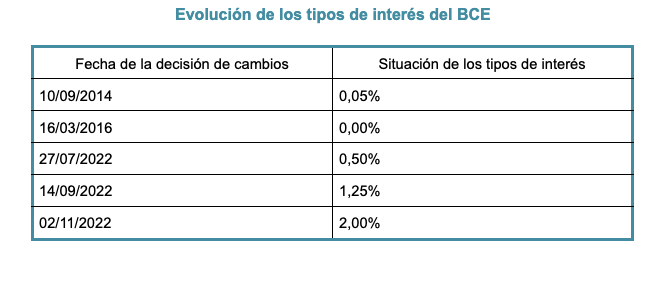

After almost 6 years with interest rates at 0.00%, the European Central Bank (ECB) has begun a program of increases in 2022. The price of money has increased up to 3 times in the period from January to November.

The first interest rate rise took place in July (50 basis points or 0.50%). Subsequently, the ECB has applied another two hikes of 75 basis points. At the beginning of December 2022, the official interest rate of the euro stands at 2.00% at the time of publishing these lines.

It is possible to verify in the graph above the verticality of the rise in reference interest rates (no less than 200 basis points in less than a year).

However, according to Pablo Hernandez de Cos, Governor of the Bank of Spain, the rates of the price of money will continue to rise until reaching levels that they can reach up to 2.5% in the first quarter of 2023.

Although these forecasts are not met exactly, it is an indication that there is still room for interest increases.

Consequences of the rise in interest rates

The changes in official interest rates pursue a specific objective: slow down the economy.

But, why would a central bank want to cool the economy? It is simply the main weapon at their disposal to maintain price stability.

The ECB's main objective is to maintain inflation at levels close to 2%. However, due to the consequences of the war in Ukraine and the consequent energy crisis, eurozone inflation it has shot until reaching 10.6% (October 2022); a historical record.

In Spain, the maximum level of inflation occurred in July 2022 (10.2%). After a few months of decline, October ended with a CPI of 7,29% (definitive data).

Despite the fact that the interest rate hike program is not as aggressive as the one imposed by the Federal Reserve of the United States, it is not without a impact on Spanish consumers and companies: credit becomes more expensive. In this way, capital flows, transactions and economic activity are reduced.

Effect of rising interest rates on the real estate sector

The consequences of the rise in interest rates have an impact on all sectors of the economy. However, the real estate sector is especially sensitive to this macroeconomic indicator, since it is highly dependent on credit, both for the purchase and sale of real estate and for their promotion.

In principle, higher inflation generates demand for real estate, because they are real goods and act as a shield against rising prices. But this effect only occurs in the early stages, when interest rates start to pick up.

As the new official interest rates are passed through to the real economy and grow the official mortgage market reference rates, real estate transactions are reduced. Thus, home prices suffer downward pressure.

In addition, developer companies demand higher profitability, as their capital costs increase.

In this context, alternative financing becomes more relevant:

- Provides easier access to credit for real estate projects.

- Faced with a rise in bank interest, alternative financing has ability to keep them.

- The financing granted is not reflected in the CIRBE (Risk Information Center of the Bank of Spain).

- Alternative financial products have a greater degree of flexibility and adaptation to the specific needs of the real estate sector, the company and the specific project.

- The company has the possibility of creating a financing mix and optimizing the credit rating through a correct diversification.

An example of alternative financing for the real estate sector can be found in the Bridge Loan for Developers. It is a financing product that offers solutions to maintain activity and create projects, despite the rise in bank interest rates.